Emerging Markets

Wake Up To Attractive Indonesia Equity Valuations, Tailwinds – Julius Baer

The populous country, a significant holder of natural resources and a youthful demography, has much to commend it in the current climate, Julius Baer argues. Stocks, which are trading cheap, are appealing in these uncertain times, it says.

Indonesian equities which trade at a cheap valuation – almost 10 times forward price/earnings – provide an attractive “hiding place” amidst volatile markets, while the country’s geopolitical situation offers comfort, Julius Baer has argued.

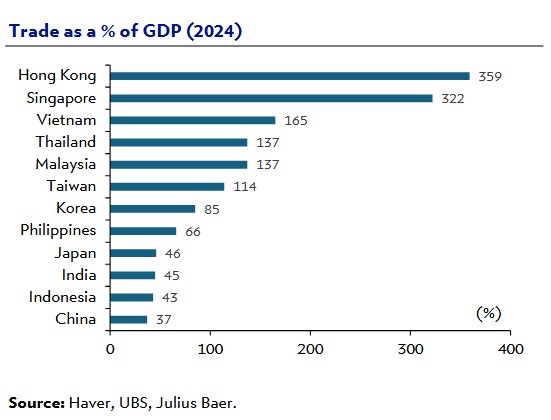

The Swiss private bank said there are “compelling opportunities” for investors. Indonesia is among the most domestically-oriented economies in Asia, with a trade-to-GDP ratio of just 43 per cent, and therefore less likely to be affected by forces such as US tariffs and other countries’ trade policies.

Only China, at 37 per cent, has a lower trade-to-GDP ratio. Top of the list is Hong Kong, at 359 per cent, followed by Singapore at 322 per cent and Vietnam at 165 per cent, the bank noted.

Jen-Ai Chua, equity research analyst (pictured below), Julius

Baer, said uncertainty over President Prabowo’s policies has

weighed on Indonesian equities. (The president’s full name is

Prabowo Subianto Djojohadikusumo.)

Jen-Ai Chua

Valuations are near the levels only seen three times in the past two decades, she said in a note.

“Critically, as the world’s most populous Muslim-majority country, its neutrality is a key asset, making it an important strategic partner in geopolitics,” she said.

Julius Baer favours a basket of large cap equities because they have corrected to “attractive valuations” as well as having defensive consumer sector qualities.

Bank Indonesia’s resumption of monetary easing in May, after a four-month hiatus and the government’s launch of a mini stimulus in early June, sets the stage for stronger growth in the second half of 2025, the analyst said.

The country, which is Asia’s sixth largest economy and the largest of the ASEAN group of Southeast Asian nations, with more than 270 million people aged 30 years and below, has much to commend it economically. It is the world’s largest producer of nickel and palm oil among an abundance of other natural resources.